Quebec-based Solotech, a leading provider of audiovisual systems and entertainment technologies, is resuming collaboration with a former business partner. The Caisse de dépôt et placement du Québec, which was already a shareholder until 2013, became a shareholder again a decade later as part of the company’s transformation.

“This is really great news,” said Solotech President and CEO Martin Tremblay in an interview Duty. The business in which the Caisse de dépôt invests today is “completely changed” compared to what the institution knew ten years ago, highlights the businessman.

At the time, the Hochelaga company employed around 600 people and “was still a local company in Quebec, Canada, doing very well but little known internationally,” he notes. Today the company employs almost 2,000 people in around twenty branches, which are spread across three continents.

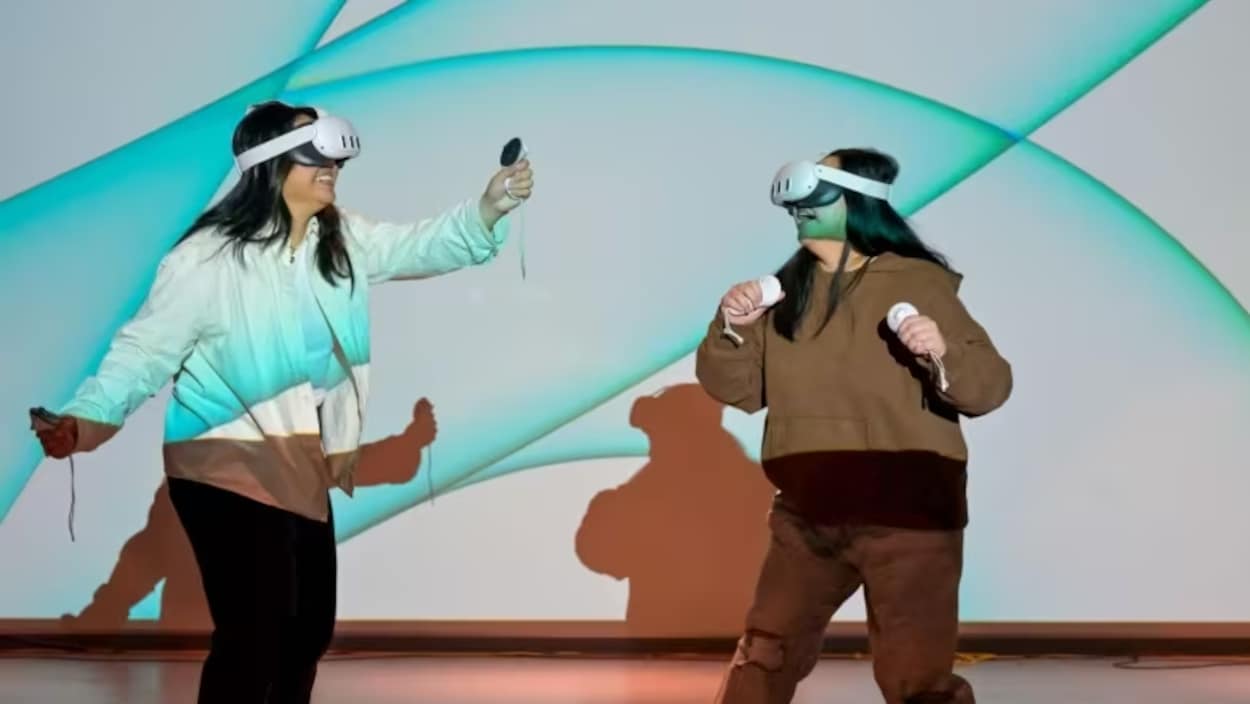

Solotech’s reputation is well established. She stands out internationally by participating in the production of major shows such as those of Taylor Swift, The Weeknd, Adele and Cirque du Soleil. The company also supplies audiovisual systems for the Bell Centre, Montreal-Trudeau Airport and commercial environments.

But Mr. Tremblay believes its growth potential is far from exhausted. The amount invested in Solotech by the Caisse de dépôt, which is not disclosed, will allow the company to finance its new phase of development. It will be used to support “its acquisition and growth strategy” and “expand its presence in various markets,” said the manager.

“Our business plan is to establish ourselves even more strongly in Europe and to continue our expansion in the USA and also in the United Arab Emirates and Southeast Asia,” he explains.

The billion mark

When Mr. Tremblay took office in 2017, the company’s revenue was about $150 million. Today there are over 650 million. And they could reach the billion dollar mark “sooner rather than later,” hopes Mr. Tremblay, thanks to the entry of the Caisse de dépôt as a shareholder.

“I dare to hope that we can achieve this within a period of three to five years. Maybe it can be faster. But we let our new partner come. And we will work with them on the strategy,” he emphasizes.

Regarding a possible IPO, the company’s number one states that this possibility has been “clearly discussed” but is not planned “in the short term”.

By acquiring a minority stake, the Caisse de dépôt is second only to Claridge, Stephen Bronfman’s investment company, as a shareholder. Investissement Québec and Desjardins Capital also own shares.

To watch in the video

Extreme problem solver. Professional web practitioner. Devoted pop culture enthusiast. Evil tv fan.